The time has come. The signs are everywhere. Maybe you don’t have time to take on new clients. Maybe you haven’t had time off in months. Or maybe your practice is growing and you need to be able to delegate some of your workload.

No matter the reason, the voice in the back of your head is saying the same thing: It’s time to hire.

Hiring seems simple enough on the surface, but the process of bringing another person into your practice should be thoughtful and deliberate. Without careful planning, hiring can quickly turn something that is meant to help you and your practice into a massive headache instead.

Between filing the proper paperwork, preparing for your new employer tax responsibilities, making sure you choose an employee that fits with your goals, and onboarding the employee, there are a lot of details to keep track of in the hiring process.

Below are a few of the most important things to remember before, during and after hiring your first employee.

Tax Considerations Mean Paperwork, Paperwork and More Paperwork

One of the first and most important things to come to grips with when considering hiring is the paperwork you’re going to need to file.

Apply for an EIN Number

Before hiring, you need to apply for an Employer Identification Number (EIN). “The IRS and state agencies will require this number for tax filings and other paperwork,” says Brittany Benson, Lead Tax Research Analyst at H&R Block’s Tax Institute. “The fastest, easiest way to get yours is to apply online. You’ll be issued an EIN immediately after you supply the needed information to an automated EIN Assistant.”

What Will Payroll Look Like?

Anyone looking to hire an employee will also need to think about payroll. There are myriad payroll options available for small businesses, such as Gusto, Quickbooks Payroll and Square Payroll. Massage therapists should do a little research on the various options to find the best payroll software for their practice.

Employee Paperwork

As you think about payroll, remember that any employee you hire will need to fill out a W-4 to withhold the correct amount of federal tax from each paycheck. Remember, a W-4 is for employees, while a W-9 is for an independent contractor. Most of the payroll software available can help you navigate payroll taxes and expenses.

“Payroll expenses are the sum you pay to employees for their labor, as well as associated expenses, such as employee benefits and payroll taxes,” Benson explains. “This is an important definition to note because you should consider your overall payroll expense when hiring a new employee.”

New hires must also fill out an I-9 form to prove they are legally eligible to be employed in the United States. “You, as the employer, are charged with verifying the information your employee has supplied by examining one or a combination of documents (U.S. Passport, driver’s license, birth certificate),” Benson says. “So you, too, will complete and sign your portion of the I-9 and keep it on file.”

Additionally, since 1996, the Personal Responsibility and Work Opportunity Reconciliation Act mandates employers report any new hires to the directory maintained by their states within 20 days of the hire date.

What to Look For When Hiring: Getting the Right Fit

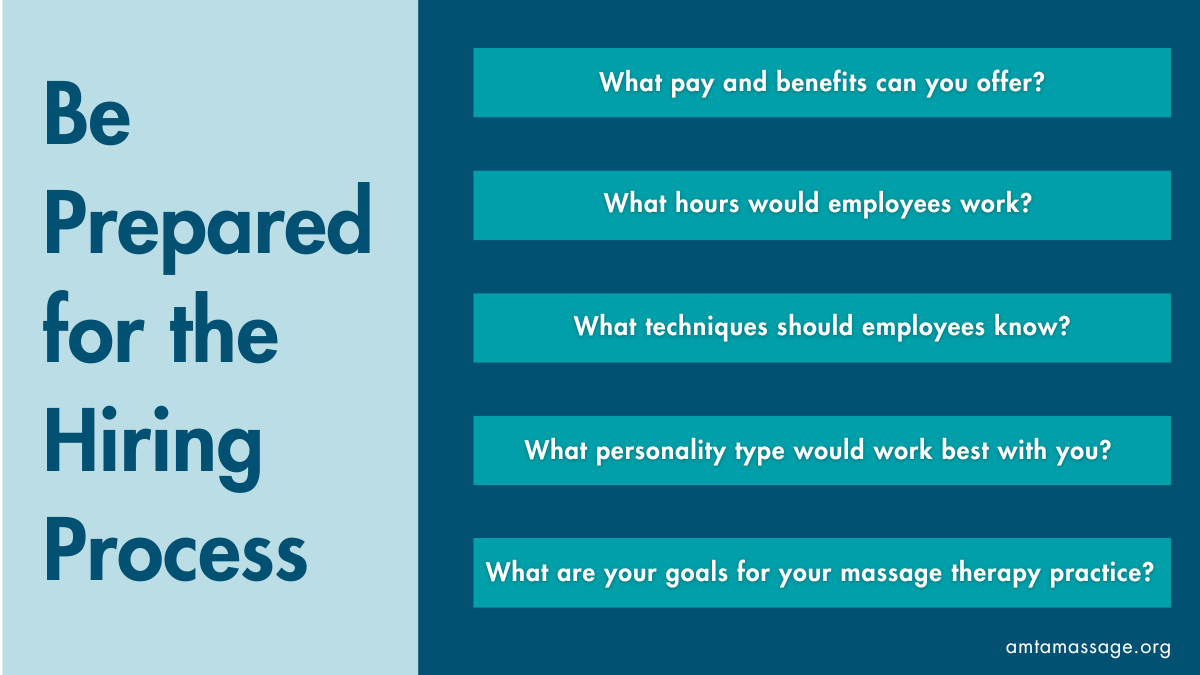

Hiring a first employee is a big decision, and deciding who among the applicants best fits your needs and culture of your practice is an even bigger decision. But, there are ways to streamline the process and make sure that hiring goes smoothly, not only for you, but also the person you’re hoping to bring into your practice.

For example, be up front and transparent about the pay you can offer (and any benefits) so that those considering applying know before they even send you their information.

“Deciding how much a new employee is paid can be one of your tougher challenges as a small business owner,” says Benson. “You want the best candidate you can find. You’ll need to find the sweet spot—the salary that will appeal to someone with your desired qualifications yet leaves some room for negotiation.”

Again, it is important to note that the salary is just one component of the overall payroll expense to consider. Things like taxes and commissions also play into the total sum.

Solid preparation is also key. You’ll have a better chance of attracting the kind of talent you want for your practice if you are very clear about what you want and need out of your employee.

- Are you looking for someone who specializes in a certain area or technique, such as Swedish, deep tissue or myofascial release?

- Do you want someone who combines a traditional technique with a more niche expertise, such as pregnancy massage or IASTM (instrument-assisted soft tissue mobilization)?

- What kind of hours are you looking for this person to work?

- What personality type will work best with your own?

These are just some of the questions you should have clear answers to before beginning the hiring process.

Another thing to consider that will help you focus on hiring the best possible fit is the goals you have for your massage practice. Be up front about what they are with any candidates to make sure they align with what the candidate is looking for in an employer. This can save a lot of trouble down the line if it quickly becomes apparent your goals don’t align.

Finally, discuss and assess the non-massage specific qualities you want in an employee during the interview process. How a person interacts with you is likely how they’ll interact with your clients, so take note of how prepared people are for the interview and share basic expectations around client interaction, dress policy, punctuality and hygiene—anything that is important to maintaining the standards that you and your clients have come to expect.

Onboarding: Getting Off on the Right Foot

Once you’ve found your perfect employee, made an offer and they accepted, the onboarding process begins.

Hiring websites like Indeed.com will sometimes have onboarding tips that might help you remember all the details that will make getting your new employee up to speed less difficult for you both.

Beyond the things that need to be done (like any W-4 or I-9 paperwork), orienting the employee to how your practice runs is important.

For massage therapy practices, this work might include:

- Showing the new employee the space where they'll be working

- Giving the new hire a tour of the office space and where they can find basic necessities like towels and sheets and anything else you intend to supply that would be used during a massage session

- Providing your new hire with any necessary sign-in information for items such as scheduling software or email

- Providing an employee handbook or any documents that outline important policies, guidelines or rules for your practice

What’s important to remember when onboarding is that this is the time to answer any questions the new hire may have, both to make sure they are comfortable in their new role and to make the transition for your practice as seamless as possible.

The purpose of hiring an employee is to make your business is more efficient, and the onboarding phase can help ensure you both get off on the right foot as you adjust to one another.

“Effective onboarding helps your newest employees feel like a part of the team and the company culture from the beginning,” says Benson. “This warm welcome makes them more likely to feel engaged, which can improve performance and encourage them to stay with the practice longer.”

______________________________

Share Your Feedback on Massage Therapy Journal

Take our quick survey to share your insights and help us enhance our publication!

Take the Survey